Health & Beauty E-commerce Insights

Health & Beauty E-commerce

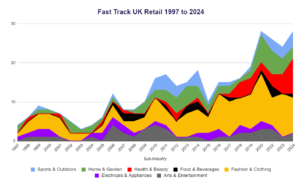

Explore how the UK’s Health & Beauty e-commerce sector has changed over the last 27 years!

By analysing the Fast Track 100 data, which ranks the top 100 UK’s fastest-growing private companies each year, we’ve seen Health & Beauty retail rise from 1 ‘bricks and mortar’ company in 1998 to 9 e-commerce brands in 2024. 📈

This surge is fuelled by rising consumer interest in wellness, product innovation, and the convenience of online shopping. Social media influencers and the pandemic have further accelerated this growth. 🌟

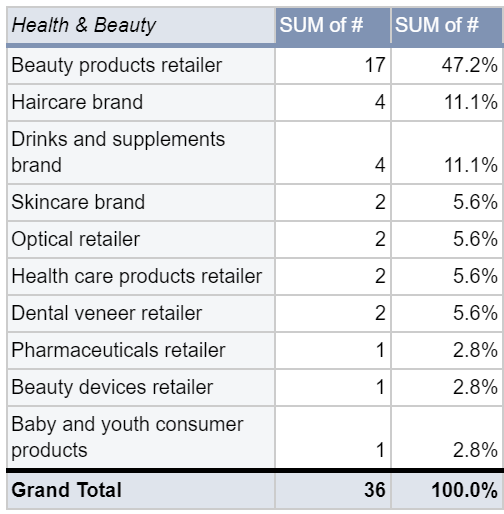

Key Insights:

- Beauty products retailers dominate the space, making up 47% of the ‘Health & Beauty’ companies.

- Cult Beauty is the only “Health & Beauty” company to feature in the Fast Track 100 list four times (2017-2020).

- Revolution Beauty has made the list three times (2018-2020).

- Other companies that have made the Fast Track list two times include: Absolute Collagen, Charlotte Tilbury Beauty, Chāmpo, Feel Unique, and INSTAsmile.

| Award Year | Rank | Name | Activity | Location | Sales £000s | Growth |

|---|---|---|---|---|---|---|

| 1998 | 2 | Optical Express | Optical retailer | Cumbernauld, Glasgow | 36,650 | 188.43% |

| 2001 | 83 | The Enterprise Department | Health care products retailer | Hertfordshire | 5,926 | 72.61% |

| 2005 | 20 | Chemicare Health | Pharmaceuticals retailer | St Helens | 12,215 | 108.72% |

| 2007 | 43 | HQUK | Beauty products retailer | Central London | 8,798 | 91.00% |

| 2011 | 24 | feelunique.com | Beauty products retailer | Jersey | 16,056 | 105.50% |

| 2012 | 10 | Lenstore.co.uk | Optical retailer | Guernsey | 5,114 | 159.15% |

| 2012 | 43 | feelunique.com | Beauty products retailer | Jersey | 26,736 | 77.97% |

| 2014 | 78 | Beautybay.com | Beauty products retailer | Manchester | 15,705 | 52.73% |

| 2017 | 7 | Cult Beauty | Beauty products retailer | Central London | 37,641 | 131.35% |

| 2018 | 3 | Revolution Beauty | Beauty products retailer | Kent | 71,788 | 152.92% |

| 2018 | 13 | Cult Beauty | Beauty products retailer | Central London | 66,742 | 125.88% |

| 2018 | 16 | INSTAsmile | Dental veneer retailer | Manchester | 5,580 | 109.45% |

| 2018 | 21 | Charlotte Tilbury Beauty | Beauty products retailer | West London | 100,653 | 102.11% |

| 2019 | 28 | Cult Beauty | Beauty products retailer | Central London | 89,000 | 86.95% |

| 2019 | 35 | Revolution Beauty | Beauty products retailer | Kent | 112,621 | 76.66% |

| 2019 | 46 | Charlotte Tilbury Beauty | Beauty products retailer | West London | 145,437 | 65.30% |

| 2019 | 49 | INSTAsmile | Dental veneer retailer | Merseyside | 6,500 | 62.76% |

| 2020 | 60 | Revolution Beauty | Beauty products retailer | Kent | 152,428 | 54.59% |

| 2020 | 67 | Cult Beauty | Beauty products retailer | Central London | 123,436 | 48.57% |

| 2022 | 4 | Absolute Collagen | Beauty products retailer | Midlands | 17,350 | 251.73% |

| 2022 | 65 | NEOM Organics | Health care products retailer | London | 41,730 | 56.16% |

| 2022 | 92 | Tropic Skincare | Skincare brand | London | 90,610 | 46.26% |

| 2023 | 8 | Chāmpo | Haircare brand | London | 8,900 | 217.33% |

| 2023 | 11 | LYMA Life | Beauty products retailer | London | 23,200 | 199.40% |

| 2023 | 35 | Absolute Collagen | Beauty products retailer | Birmingham | 22,200 | 104.04% |

| 2023 | 47 | grüum | Haircare brand | Stockport | 5,600 | 83.84% |

| 2023 | 89 | CurrentBody | Beauty devices retailer | Manchester | 59,100 | 55.10% |

| 2024 | 3 | Rheal | Drinks and supplements brand | Sunderland | 19,800 | 243.02% |

| 2024 | 4 | TRIP | Drinks and supplements brand | London | 20,000 | 224.75% |

| 2024 | 5 | Ancient + Brave | Drinks and supplements brand | East Sussex | 10,200 | 222.51% |

| 2024 | 8 | Heroes | Baby and youth consumer products | London | 82,200 | 201.43% |

| 2024 | 29 | Plantmade | Haircare brand | Reading | 5,300 | 135.88% |

| 2024 | 39 | Chāmpo | Haircare brand | Worcestershire | 14,100 | 121.76% |

| 2024 | 52 | 47 Skin | Skincare brand | York | 8,500 | 99.38% |

| 2024 | 59 | Only Curls | Beauty products retailer | London | 13,300 | 92.81% |

| 2024 | 77 | Applied Nutrition | Drinks and supplements brand | Liverpool | 61,200 | 76.11% |

Want to learn more about the Rise of E-commerce in the UK

Click this link to read more about the “Rise of E-commerce in the UK from 1997-2024”.

Britain's fastest growing private companies from 1997-2024

What is the Fast Track 100?

The Fast Track 100 league table ranked Britain’s 100 private companies with the fastest-growing sales over their latest three years. It is compiled by Fast Track and published in The Sunday Times each December. It ran from 1997 to 2020, until 30th June 2021 when the Fast Track company was closed down due to the Covid-19 pandemic causing too much uncertainty over continued sponsorship.

In 2022, The Sunday Times announced it was restarted the Fast Track 100. It is branded as – The Sunday Times Hundred 2022.

A typical Fast Track 100 company:

- is owned and run by entrepreneurs

- has between 20 and 500 staff

- has average 3 year sales growth ranging between 45% and 250% pa

- has sales ranging between £5m and £100m

- 25% of the companies have venture capital backing

Fast Track 100 League Tables 1997-2024

Book your FREE strategy session!

On your free phone consultation, one of our experts will discuss the following:

- Your business, your goals and what success means to you

- How our approach to digital advertising will achieve your goals

- Whether we're a good fit for one another (we certainly hope so)

There’ll be no commitment or obligation to use our services.